1. Introduction

1.1 Overall Options Trend

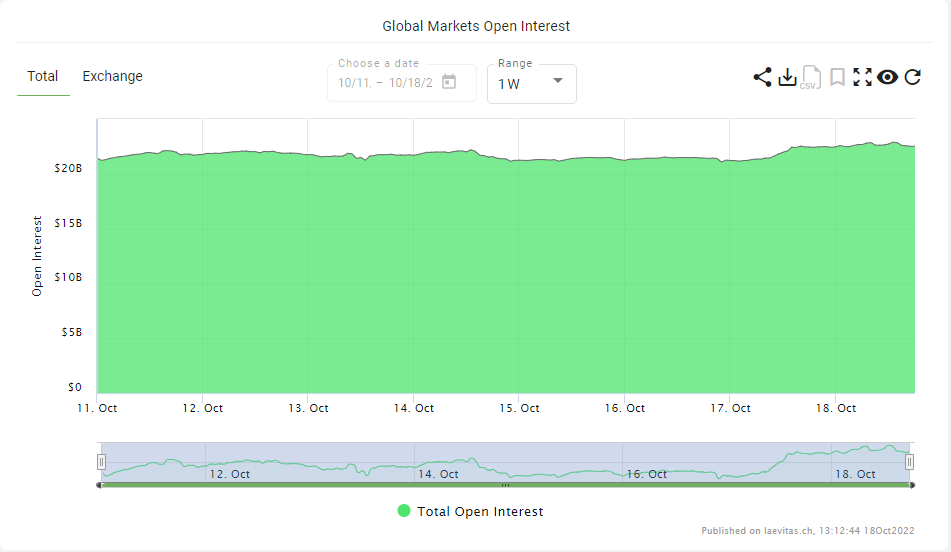

-Total open interest for futures across crypto

-Total open interest for options across crypto (premium, not notional)

The graphs above compare crypto futures open interest to options open interest. We can see that option products are still utilised much less in terms of OI relative to futures ($400mm vs $20b). For a little more context of how much space there is to grow for options, the notional value of outstanding derivatives for equities was $610 trillion (source) in June 2021, whereas today in crypto, that number is only $11b.

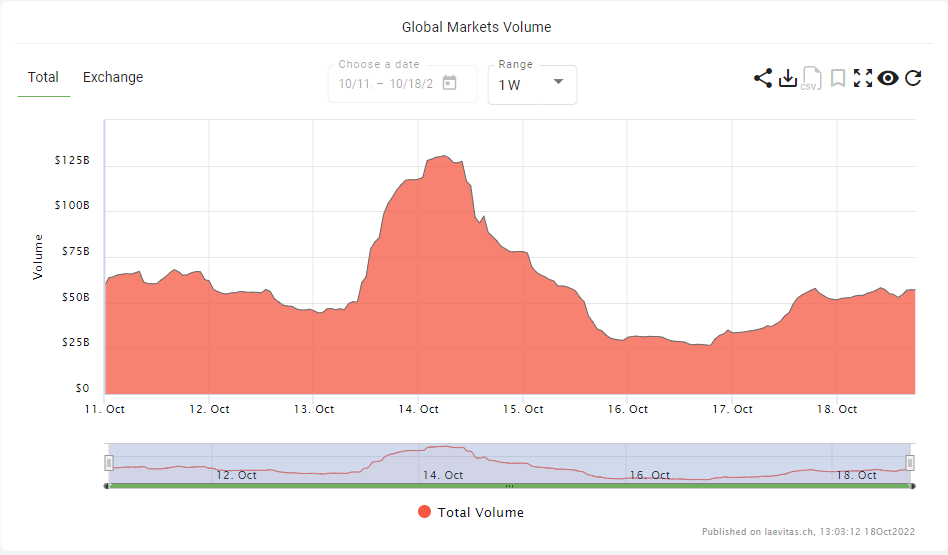

-Total crypto 24hr volume across all instruments

-Total crypto options 24hr volume

From the graphs above we can see that there is a huge gap in volume between crypto options ($20mm 24 hr volume) products and overall crypto volume ($50b 24hr volume). For context, in 2020 in tradfi equity markets, stock options trading volume surpassed that of the underlying stock for the first time (source), driven by a flood of demand from inexperienced and risk loving traders on the popular app Robinhood. Given crypto’s particular allure to risk loving individuals, we should see a similar trend and there is clear space for crypto options volume to grow. However one thing to note is that leverage in crypto is relatively cheap and easily accessible through perpetual futures, so overall we may see less demand for options relative to traditional equity markets as retail has other products to take on leverage.

1.2 What are Options used for?

Hedging

Options allow you to express a multitude of views on the market, including direction, extent of direction, volatility and time.

All of these result in options often being utilised as hedging products, especially by traders or portfolio managers during potential downside scenarios.

Income

Options allow you to generate income on underlying assets, mainly by selling puts or calls options.

Represent another form of income generation on top of existing assets such as margin lending/staking/yield farming/funding on perpetual futures (slightly different).

Speculation

Options have a non-linear payoff due to their convexity. This is a result of gamma, one of the greeks of an options contract.

Similar to perpetual futures, options provide access to leverage, and thus could have a higher payoff if you are willing to take a higher risk and pay the premium.

1.3 Comparing Options vs Structured Products

Within crypto, structured products are pre-packaged products that utilise various financial derivatives. Like options, they can be used for income, to hedge or to speculate. The most common structured products within crypto are vaults, mainly covered call vaults or cash secured put vaults, that allow you to generate yield on a stablecoin such as USDC or tokens such as BTC/ETH/SOL etc.

The main way in which these structured products operate is by selling calls or puts to various market makers through auctions, and thereby allowing the vault to collect premiums on the underlying as “yield”. In some sense, LPing for options protocols with AMM mechanisms could be seen as a structured product.

The link between structured products and options protocols is that structured products can often drive consistent flow/liquidity to options protocols, as TVL within decentralised option vaults results in higher options liquidity. This can also be a problem as every decentralised options vault (DOV) wants to run their auctions at the same time coinciding with options expiries, so sophisticated players can front-run the auction, resulting in dampened returns for DOV investors.

Will cover crypto structured products in another research report. Stay tuned for it!

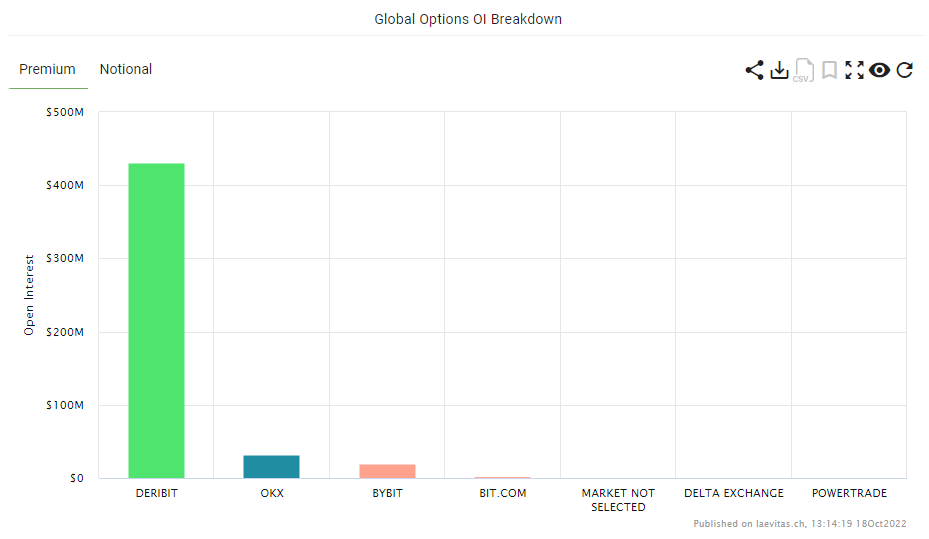

1.4 Deribit (Largest Options CEX) vs On-chain Options

As of right now, Deribit is the clear winner in terms of options exchanges. Due to the fragmentation of expiry and strikes with options products, liquidity can be fragmented and thus liquidity is a big moat that Deribit has built out. Currently Deribit only has BTC/ETH/SOL options, with a significant lack of liquidity at more extreme expiries and strikes. In addition, Deribit accounts are coin margined, which makes managing your options position very troublesome, it’s essentially like trying to trade a BTC/ETH/SOL denominated account rather than a USD denominated account. The caveat is that users can synthetically convert their account to USD denominated by shorting Deribit perps, although that adds an additional execution step. They are also not accessible for a few regions (especially US).

In general market makers on central limit order books are less willing to market make for options as they are harder to hedge and require more effort/sophisticated models for them to price correctly. The main question within pricing on-chain option products accurately is implied volatility (IV) and how to determine what is the “correct” IV. Within the Black-Scholes formula, all other variables such as strike price, time to expiry, spot price are known and the same to all parties, the one slight exception would be the risk free interest rate which different parties would interpret differently. Normally implied volatility (IV) is a function of demand and supply for the option contracts, higher demand and less supply will result in a higher IV and vice versa, lower demand and higher supply will result in a lower IV. But with on-chain options, due to inconsistent flow (demand & supply) and the lack of price discovery mechanisms on-chain, IV is hard for options protocols to gauge correctly, which is the key factor in options pricing. In addition, in many liquidity models, on-chain liquidity providers are not able to define their exposure, and thus their risk.

Clarifications: On-chain option protocols don’t necessarily have to be fully decentralised. Some options protocols, especially ones that rely on central limit order books, will still require centralised market makers to provide liquidity, unless generic market making algorithms are solved or structured products such as DOVs are able to provide enough liquidity across tokens/strikes/expiries. It is possible for on-chain options to have decentralised infrastructure, or decentralised participants, or both. Decentralised infrastructure refers to the underlying system that the options exchange is built on, and it will most likely have to run on a blockchain network that anyone can validate and operate in a permissionless manner, e.g. anyone can continue to validate transactions for a CLOB or the AMM, or anyone can come in and create new markets and provide liquidity if they wanted to. Decentralised participants refers to the exchange not having to rely on singular or centralised entities to function, e.g. you don’t require a centralised market maker to come in and provide liquidity, anyone with the necessary assets and not necessarily the pre-requisite technical knowledge is able to provide liquidity. An options protocol that has both decentralised infrastructure and participants will likely have to rely on an AMM model so that anyone can create option markets and permissionlessly provide liquidity for them.

2. Thesis

Just like how Uniswap allows individuals to create markets through liquidity pools for long tail assets (generally low liquidity/volume, smaller marketcap/FDV and hard to trade due to lack of existing markets/products) in a permissionless and decentralised manner, I believe the same will occur for options. This is conditional on someone figuring out an efficient/effective liquidity model that allows users to create option markets for long tail assets and a price discovery mechanism that efficiently adjusts itself to demand and supply within the market.

Allowing individuals to efficiently hedge/speculate/generate income on assets through options will be a key component for this space to grow. The crypto space has grown exponentially already, yet there are really only liquid option markets for BTC/ETH which makes hedging products for every other non-BTC/ETH token in high demand.

I believe the best model that allows for a permissionless options exchange with sufficient liquidity would be a hybrid liquidity model running on a central limit order book. Participants that are able to market make options will be able to submit their limit orders or participate through a RFQ system, while individuals who would like to provide general liquidity can do so through liquidity pools that will submit resting orders within the market, perhaps being able to quantify their risk/exposure in a more granular manner compared to current options liquidity pools. This would allow individuals to create and provide liquidity for long tail assets even with the lack of a proper market maker for that token and would allow for more efficient options price discovery mechanisms.

To clarify, there is nothing wrong with Deribit, Deribit is an amazing product for what it offers (BTC/ETH/SOL options & perps), and therein lies the problem. It’s what they don’t offer that drives my thesis for On-Chain options protocols, infrastructure that enables participants to trade options on long tail assets, developers to build options on other underlying assets such as NFTs, and to build a composable future for financial assets (e.g. using your options position as collateral for something else).

3. On-Chain Options Landscape

3.1 Options Protocols

Lyra

https://app.lyra.finance/

Chain: Optimism

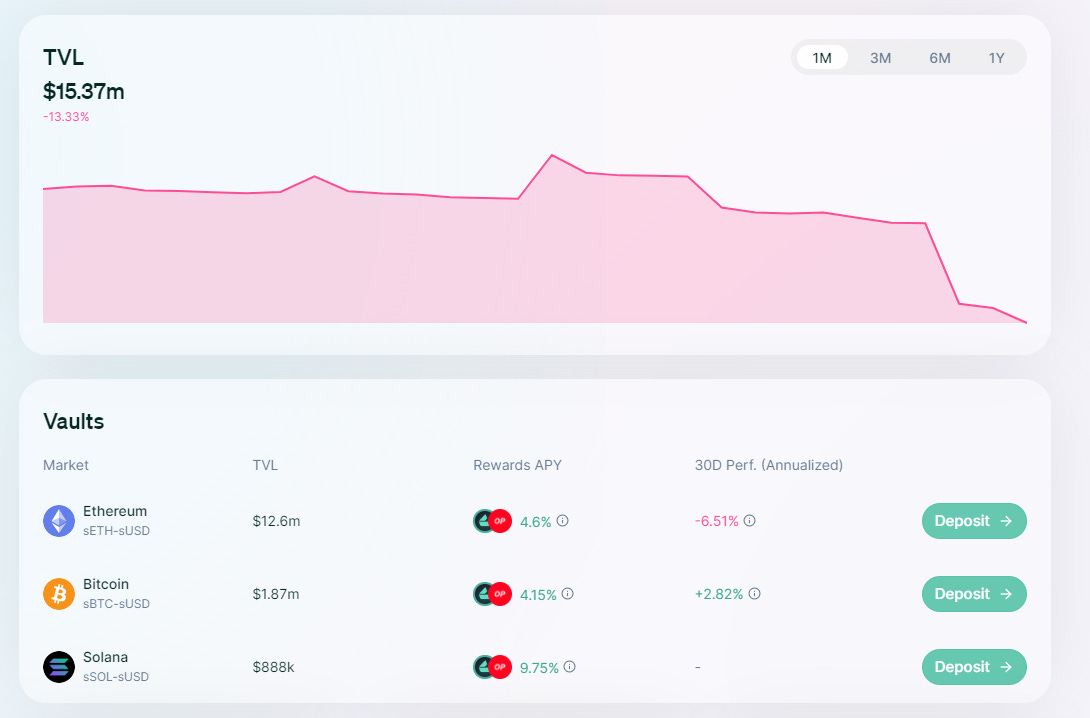

TVL: $15mm

Assets: BTC, ETH, SOL

Liquidity Model

Liquidity providers deposit sUSD into a delta hedged pool depending on what asset they want to provide options liquidity for.

Lyra determines a market driven value for implied volatility and sets a base implied volatility for each strike.

Lyra increases or decreases the baseline IV for an AMM pool by a fixed 1 percentage point that is based on the volatility level of the AMM liquidity pool for every standard size trade (a protocol defined metric that determines trade impact per options contract ). The standard size will be proportional to vega. A lower standard size would result in a more sensitive IV which occurs at lower vegas.

Lyra utilises a skew factor to account for the skew in implied volatility for various strikes.

Fundamentally, as the AMM sells options, the volatility curve is shifted up and vice versa, if the AMM is buying options, the volatility curve is shifted down.

The AMM aims to be delta neutral by either buying or selling the underlying synthetic asset using Synthetix protocol assets.

Option LPs will make money inversely to the profit of option traders on the platform, similar to GMX and its GLP liquidity pool mechanism.

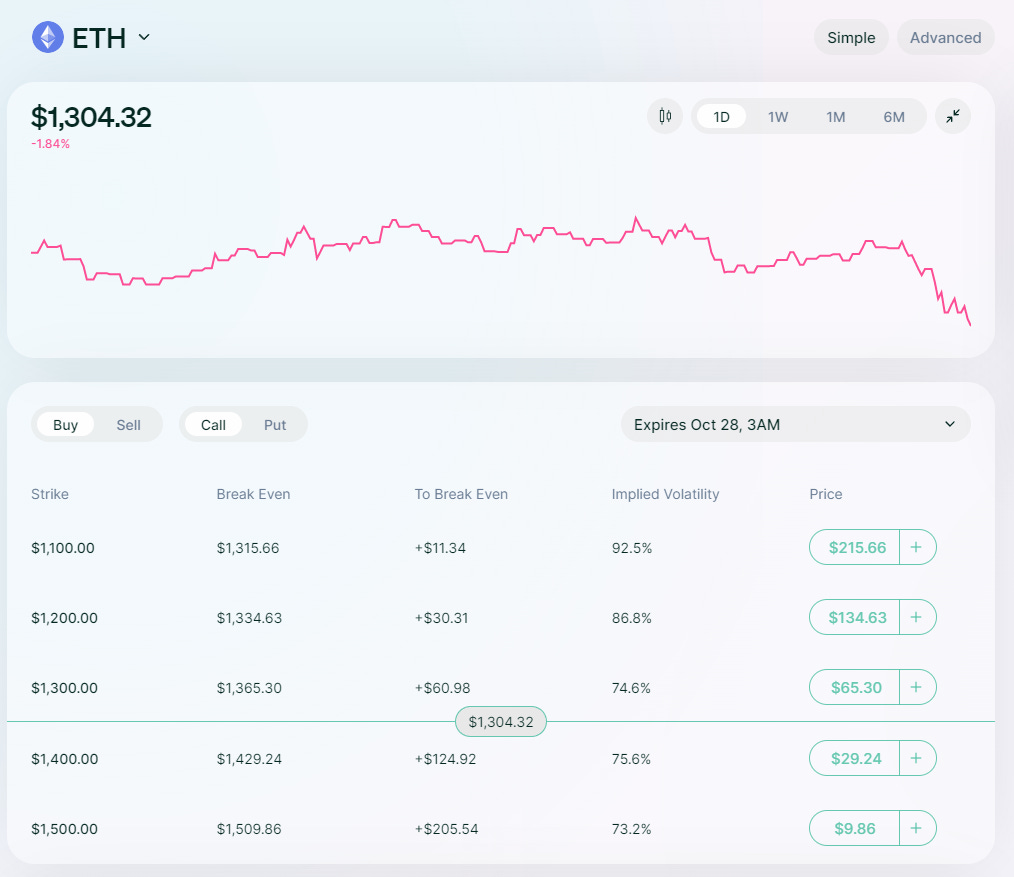

-UI for liquidity providers

Users

Users are able to buy or sell call and put options on BTC, ETH & SOL.

Weekly expiries up to 30 days that coincides with 8am UTC Deribit expiries.

Users are offered a limited amount of strikes, most of the time 5 strikes around the current spot price.

Strikes are not fixed, and can differ across expiries.

-UI for option buyers

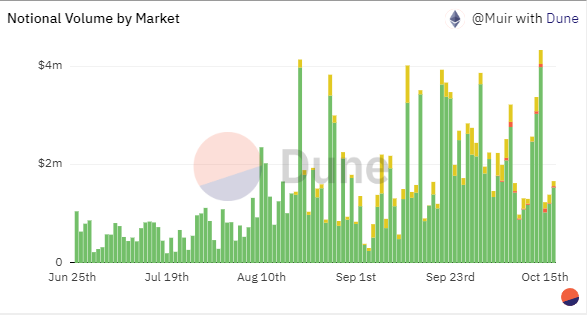

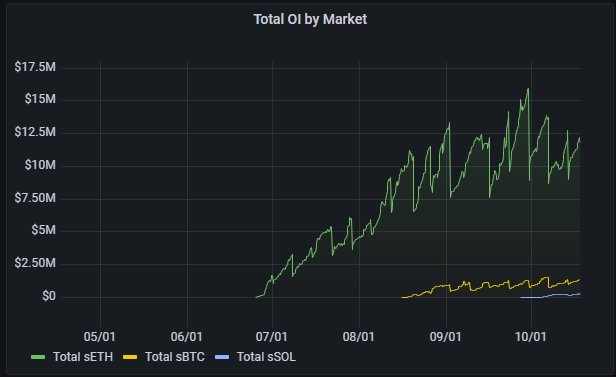

Traction

Slowly increasing volume and increasing total open interest.

Would suggest that more options positions are being opened but traders are trading or closing positions less.

Strengths

Matching expiries to Deribit, allowing for arbitrage opportunities, although small in size.

Ability to deposit or withdraw from the LP anytime in most scenarios.

Partial collateralisation for short selling of options.

Simple to use UI, especially when selling options

Relatively fair liquidation penalty of 5% with 10% of that going to liquidators.

Weaknesses

Liquidity mechanisms such as the pool running low on liquidity or diverging volatility that results in withdrawals being blocked.

Hindsight is 20/20 but Arbitrum would have been a better L2 to deploy on instead of Optimism.

Vaults have limited liquidity, ETH $12.6mm, BTC $1.877mm, SOL $888k.

Risk with utilising Synthetix Protocol tokens, e.g. sUSD isn’t always at peg 1:1.

Trading cutoffs, e.g. can’t open new positions with less than 12 hours to expiry, tradfi markets can trade all the way to expiry.

Delta cutoff range between 10-90, so if spot price of token moves a lot you have to use a ForceClose mechanism that incurs a penalty.

Very weak returns for LPs, especially taking into account decreasing OP and Lyra incentives.

Dopex

https://app.dopex.io/

Chain: Arbitrum

TVL: $10mm

Assets: ETH, DPX, rDPX

Liquidity Model

Liquidity providers can only sell options, they deposit the necessary collateral for a call or put at a strike they choose from a pre-set list.

There are different vaults depending on whether you want to sell options with weekly or monthly expiries, the protocol works in epochs.

There is no volatility calculator or adjusting mechanism on Dopex. Option price discovery does not take place on Dopex and they use Deribit IV’s to price their options.

Users

Users are able to purchase the options with weekly and monthly expiries.

There is no slippage when purchasing options as there is no price discovery.

You may not be able to purchase an option if there is no more liquidity left, e.g. not enough people deposited into the SSOV.

-User interface to write an option

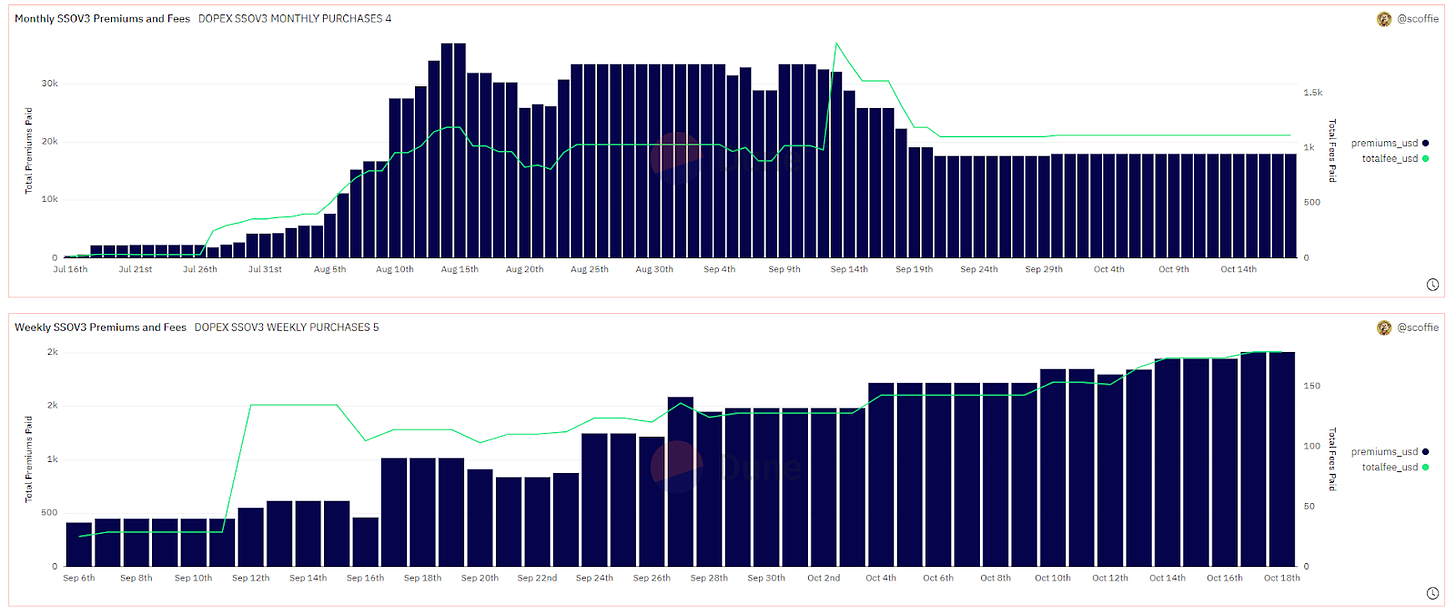

Traction

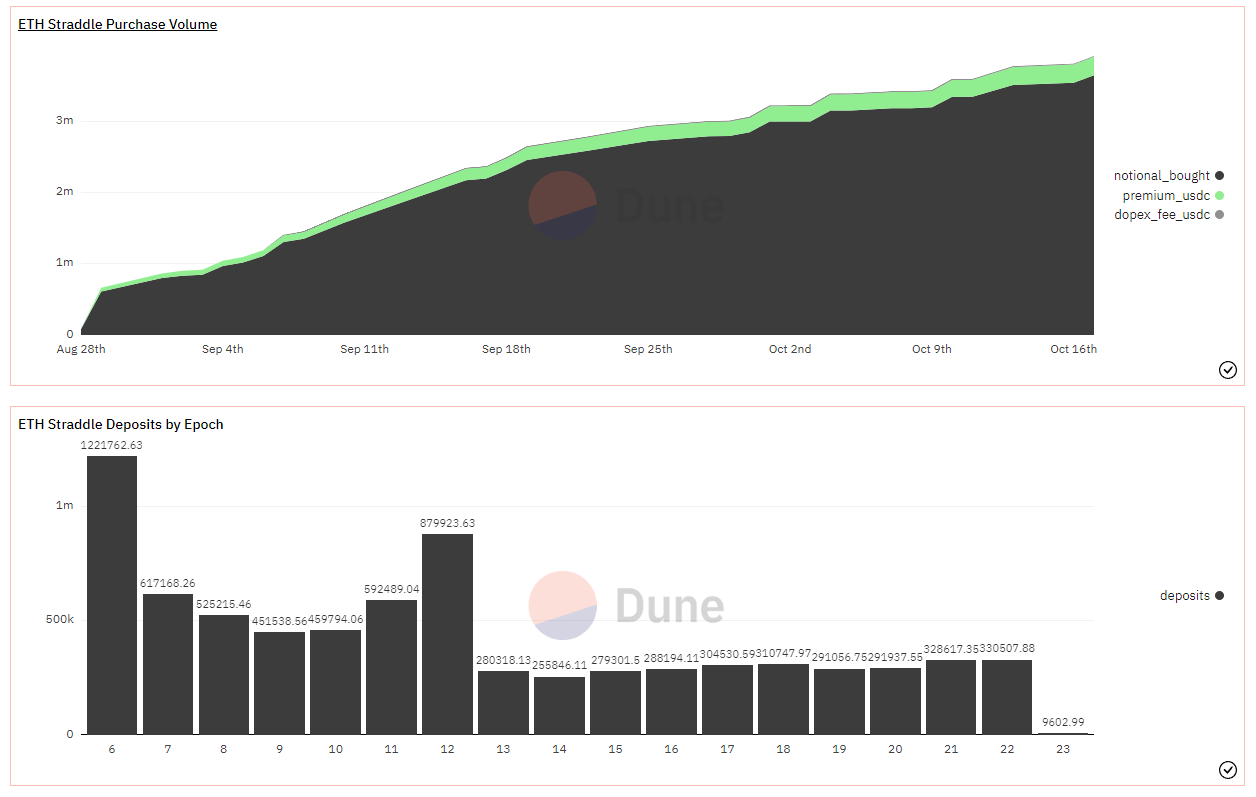

We can see from the above graphs that depicts SSOV premiums & fees along with ETH straddle purchase volumes & deposits that activity is plateauing, if not slowly increasing.

Strengths

Innovative options products such as Atlantic Straddles integrated with GMX or Interest Rate Options.

Zero slippage execution for buyers as the price is determined through a pricing formula within the smart contract, what you see is what you get.

Strong community, pepe memes, partnerships with other protocols such as JonesDAO.

Weaknesses

Weak liquidity and options tend to sell out very fast when they are open for purchase as there are insufficient depositors, Atlantic Straddles sell out in 1 minute every epoch.

Cannot close options positions before expiry.

Option sellers cannot control when/who purchases the options you wrote, resulting in sellers not being able to calculate your premium received when you enter the vault.

UI is fairly unintuitive and clunky, lack of good analytics/visual guides for average users.

Some of their innovative products are only seen as innovative due to the collateral inefficiency of defi options. E.g. its atlantic straddles are only seen as innovative due to the fact that on-chain option sellers need to be fully collateralised under Dopex’s settlement mechanisms.

Zeta Markets

https://mainnet.zeta.markets/

Chain: Solana

TVL: $12.5mm (Total Open Interest)

Assets: BTC, ETH, SOL

Liquidity Model

Orderbook based options protocol in comparison to vault based liquidity models.

Has a backup dynamic Options Market Maker (OMM) that can always guarantee liquidity in the scenario where there aren’t many market makers or deep liquidity. (Does not seem to be live, confirmed in Discord).

Invested by crypto trading firms such as Jump/Wintermute/Ledger Prime/Alameda but available liquidity seems to suggest not much support.

Users

Users can both buy or sell options on a few tokens, e.g. BTC, ETH, SOL.

Users can trade perpetual futures too.

Margin account for each asset and only accepts USDC as collateral.

Supports Good-Til-Cancelled orders, this is the default.

-Trading Interface

Traction

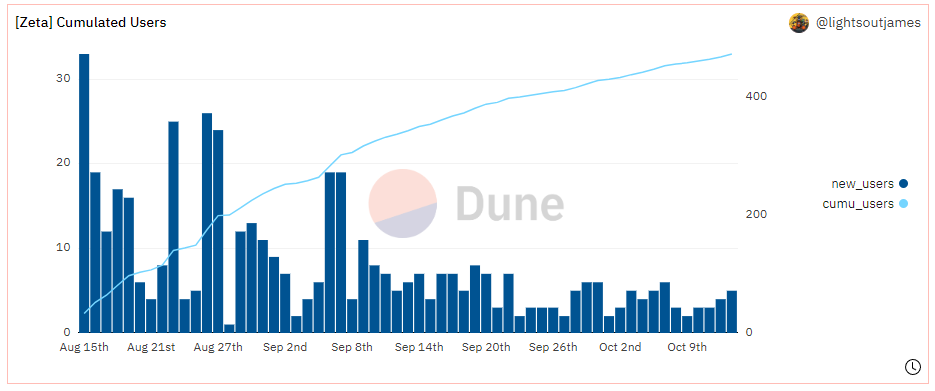

New users seem to be decreasing.

Strengths

Same options expiry as Deribit.

Options are margined in a similar style to futures.

Cross margining between their perpetual futures and options which allows you to structure more interesting trades.

Useful volatility adjustment mechanism that is perhaps more efficient than other AMM or vault based volatility adjustments for their OMM.

Weaknesses

Weak UI, very messy and non intuitive both for professional options traders and for retail users.

Very wide spreads for options with extreme deltas and a lack of overall liquidity on the platform.

Completely empty orderbook regardless of OMM.

Deribit is almost the entirely same product just off-chain.

Premia Finance

https://app.premia.finance/

Chain: Ethereum, Arbitrum, Optimism, Fantom, Polygon/Avalanche (Coming soon)

TVL: $7.3mm

Assets: BTC, ETH, WFTM, YFI, LINK, ALCX, alETH, OP

Liquidity Model

AMM based options pool that only sells options.

LPs can withdraw their funds after an initial 24h lock.

Similar mechanism to Dopex where liquidity providers provide liquidity in a first in first out (FIFO) sequence.

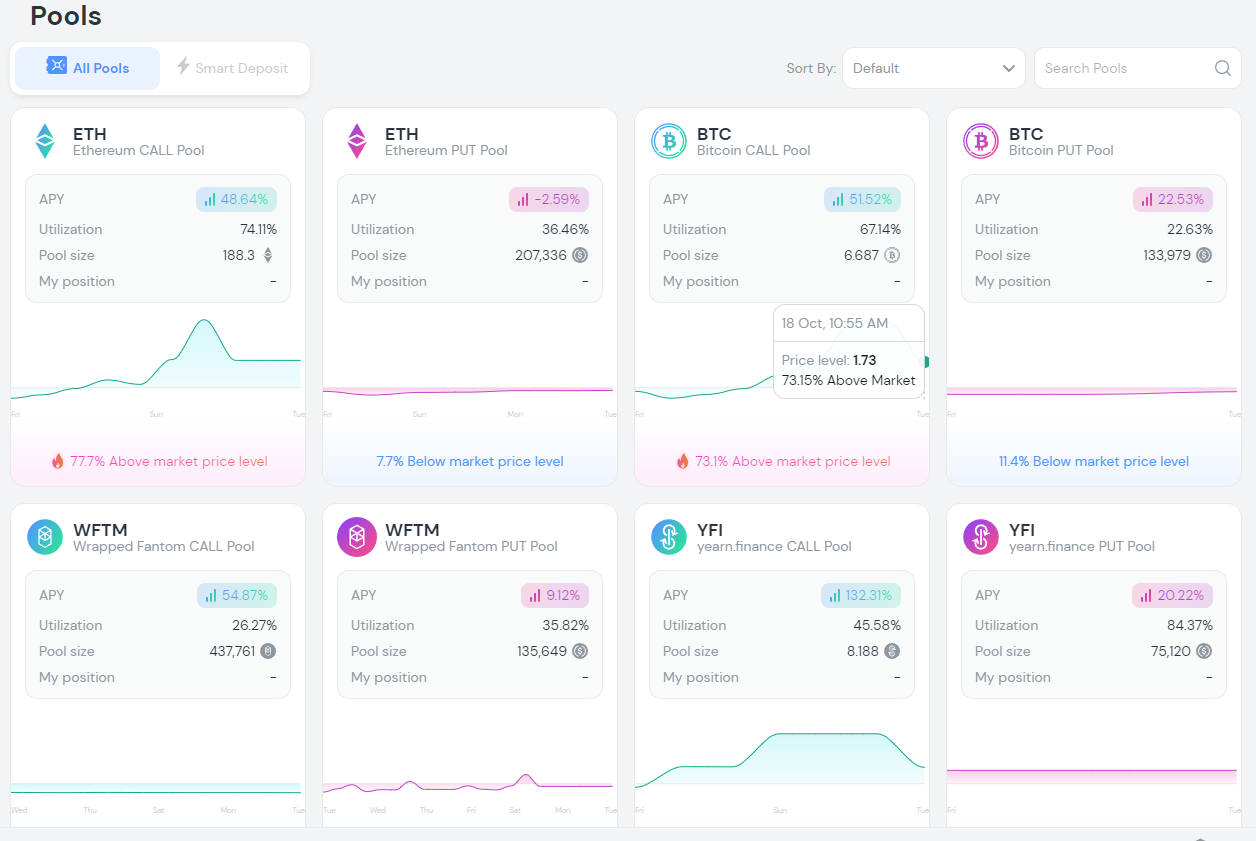

If the pool utilisation is below a desired threshold, the protocol will underprice implied volatility resulting in very cheap options, vice versa, if pool utilisation is above a desired threshold, the protocol will vastly overprice implied volatility resulting in very expensive options.

This can result in option premiums where IV is underpriced by 30% or overpriced by up to 80% which is very significant and represents an inefficient market.

~Interface for providing liquidity into call or put vaults

Users

Users can buy calls or puts for the available assets.

Able to customise strike and expiration date even if it is not under the available options.

The protocol will calculate the options premium given your chosen strike and expiry date.

Larger trades will incur a size adjustment, more commonly known as slippage.

-Interface for purchasing call or put options

Traction

From the above graphs from Apr 2022 to today, we can see that total volume locked in liquidity pools and total traded volume have both been in a steady downtrend.

Strengths

American options that allow you to exercise before expiry.

Has a wide variety of strikes and expiries that you can customise and choose from.

One of the most accessible UIs for new option traders.

V3 will allow LPs to provide liquidity for specific contracts, but this may fragment liquidity.

Weaknesses

Has a volatility adjuster called the C-level to adjust for pool utilisation which should theoretically result in a no arbitrage condition but because demand for defi options is volatile, this often results in severely overpriced or underpriced options.

Not a huge amount of liquidity with large spreads if you want to close your position through selling back rather than exercising. Even small positions such as 1 BTC or a few ETH result in you shifting the markets quite significantly.

Hegic

Chain: Ethereum and Arbitrum

TVL: $2mm

Assets: BTC, ETH

Liquidity Model

Utilises a stake and cover model, basically a liquidity pool that acts as a counterparty to traders.

Receive P&L in USDC and net P&L settlement is conducted on a monthly basis.

Users

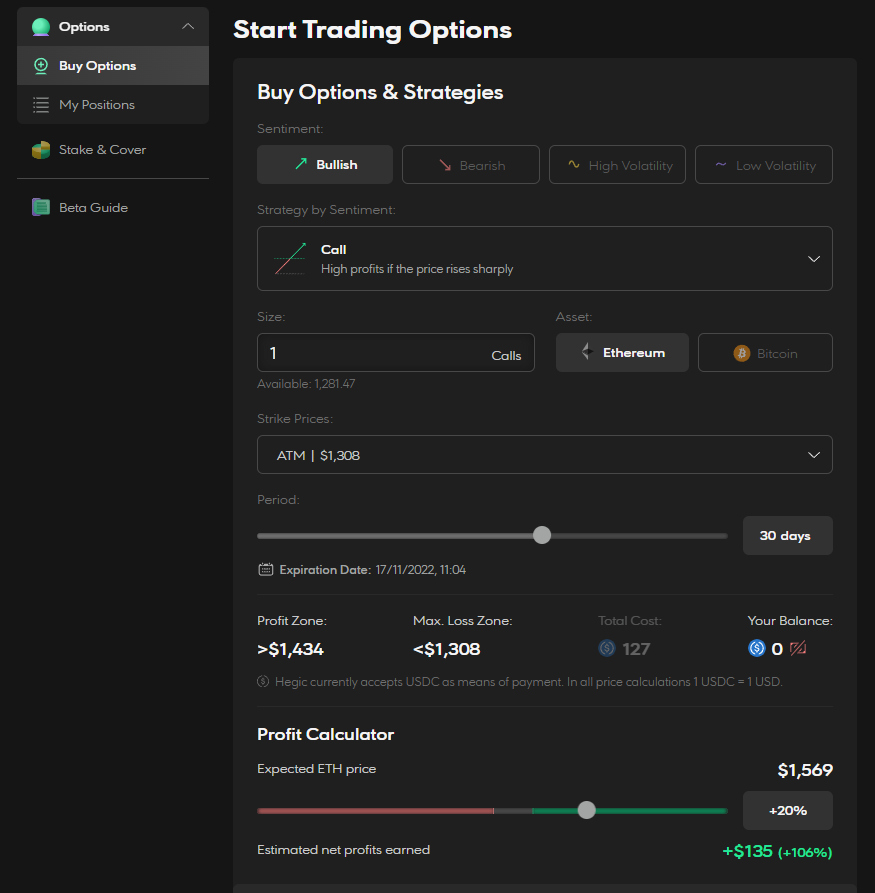

Users can buy BTC and ETH options, either ATM or maximum 30% OTM with some automated strategies such as buying volatility or selling volatility.

Long puts and calls ATM or 10/20/30% OTM, with expiry set anywhere between 7 and 45 days.

ATM straddles with expiry up to 30 days.

10/20/30% OTM strangles, butterflies and 20/30% for condors.

-UI for buying an option

Traction

From the graphs above that show TVL for liquidity pools and trading volumes, we can see that both are in significant downtrents.

A dismal amount of TVL with $750k on Mainnet and $1mm on Arbitrum.

Strengths

1 click options strategies such as butterflies and condors.

Can choose expiries anytime from 7 days to 45 days for strangles/puts/calls..

Weaknesses

Non intuitive UI, PnL models are different from what options traders are used to.

Wildly outdated documentation and significant lack of user guides.

No change at all in options pricing regardless of what size you purchase, means that there is no volatility adjusting mechanism and the protocol uses a fixed IV. A significant flaw in market clearing mechanisms are prices don’t adjust for demand and supply.

Very rudimentary pricing model for option premiums with fixed multipliers for different strikes given OTM or ITM percentages.

Notable Mentions

Synquote

https://app.synquote.com/trade/

Chain: Polygon

TVL: Newly launched

Assets: ETH, BTC, LINK, AVAX, MATIC, BNB

Plans on supporting options on 500 illiquid instruments on Polygon, Avalanche and BNB Chain.

Incubated by Alliance DAO and strong support from Polygon team.

Provides European options.

Utilises a RFQ model for liquidity, relying on market makers being willing to provide liquidity.

Aevo

https://www.aevo.xyz/

Q4 2022 launch.

CLOB for Options, build on a custom EVM rollup.

Will have 100+ instruments, with many strikes and expiries.

Deep liquidity, by partnering with the best option trading firms that will only come on with CLOB, as you can’t really market make on a DOV.

Instant onboarding, deposit USDC from any EVM chain.

Ribbon users’ funds may no longer need to be locked up from a week-to-week basis.

Ribbon Auction participants will also benefit greatly from this integration. Instead of sitting on oTokens in their wallet until expiry, market makers can use these vault positions as real positions on an exchange — giving them margin to trade more things, take profit, hedge, and so on.

Eventually Aevo will integrate with Ribbon where Ribbon vaults can drive consistent flow to Aevo. Currently Ribbon auctions drive $80mm of flow a week.

Note: Out of all the above on-chain options protocols, I’m most bullish on Aevo and Synquote due to their scalability and liquidity models. I don’t think many of the protocols mentioned above survive long term in their current state. Ideally, an On-Chain options protocol works efficiently even in the depth of the bear market with less liquidity and participants, and that is just not the case right now.

3.2 Liquidity Models

Pooled Liquidity Vaults

In a pooled liquidity vault, users can deposit stablecoins or the underlying asset into a vault, which acts as an automated market maker and the counterparty to all trades.

There can be a pooled liquidity vault for that asset which includes both calls and puts or separate liquidity vaults for calls and puts.

A pooled liquidity vault would likely accept stablecoins whereas separate liquidity vaults would require the underlying asset for the call pool and stablecoins for the put pool.

In general, a pool should seek to maintain your exposure to the underlying asset you deposited. Which means that for example, if you deposited a stablecoin into the liquidity vault, the protocol will often delta hedge the liquidity pool periodically by buying or selling the underlying asset to make sure you have no directional exposure.

Strengths

Liquidity is not fragmented and provided across the entire range of strikes and expiries

Always a counterparty to trade against assuming the pool utilisation is < 100%

Simple for liquidity providers who don’t want to choose and define their risk exposure, deposit and forget.

Weaknesses

Cannot specify your risk exposure as you are providing liquidity to the entire options chain across all strikes and expiries depending on buyer behaviour.

Your capital can be tied up for an indefinite period of time if the pool utilisation is 100% and users keep on opening up new positions.

Ideally you want the pool utilisation to always be 100% so liquidity providers are generating the most returns, but like lending/borrowing protocols, that results in liquidity providers being unable to withdraw capital. Simultaneously, a 100% pool utilisation will result in option premiums being vastly overpriced for that specific pool.

On the converse, if pool utilisation is < 100%, say 60%, then only 60% of the capital within the liquidity pool is being used and returns are being diluted across all liquidity providers.

It is fundamentally hard to balance pool utilisation with diluting returns (it’s a problem that money market protocols haven’t perfectly solved too), especially when pool utilisation is the main factor that determines options pricing on pooled liquidity vault option platforms.

Single Liquidity Vault

In a single liquidity vault, you provide liquidity by depositing either the underlying token for calls and stablecoins for puts into a vault with a specific strike and expiry date.

Generally, you would be able to withdraw your liquidity once the expiry date has passed or the epoch has ended with no option for early withdrawal.

Once you deposit liquidity, you have essentially sold an options contract and are waiting for a buyer to come along and purchase the options contract based on a queue that is first in first out.

Strengths

You are clearly able to define your risk and exposure as you know your time to expiry and strike price that you have selected, from there you can hedge your exposure as it is defined.

As a buyer of options, you can essentially purchase options with zero slippage at what is determined to be the fair price by the options pricing mechanism.

Weaknesses

Unable to close your position prematurely if you are a liquidity provider or an options buyer.

Even though you are able to define your exposure, you do not know how much premium you will receive due to the first in first out auction sequence, and more specifically, you do not know the spot price and IV of the underlying asset when the options get purchased from you.

Liquidity is fragmented across strikes and expiries, meaning that even though there may be liquidity for other strikes and expiries, if none is left for the strike and expiry you would like to purchase, you will not be able to do so.

Central Limit Order book

In a central limit order book, you provide liquidity by making a market, or in more general terms, placing limit orders that act as liquidity for other traders.

On a central limit order book, there are often two types of orders, limit orders and market orders. A market order occurs when a trader buys or sells at the best market price available at that moment. A limit order occurs when a trader is willing to buy or sell the token at a specific price, which is often not executed instantaneously.

Market makers are generally large institutions with the technical knowledge and infrastructure to do so.

Market makers provide liquidity, which is reflected by the spread, the difference between the bid and ask.

Strengths

Better execution for traders and reduces the risk of slippage assuming there is sufficient liquidity.

Familiar for both retail and institutional traders.

Generally allow for more efficient and better price discovery than an AMM.

Weaknesses

Liquidity is fragmented across the various strikes and expiries.

You have to rely on a centralised market maker to provide liquidity which acts as a barrier to entry for permissionless markets.

Does not work well for illiquid markets or you cannot trade if the highest bid is lower than the lowest ask.

4. Conclusion

In its current form, on-chain option protocols leave a lot to be desired. There is no protocol close to resembling a winner, in fact I’d go so far to say there’s nobody that is close to resembling a viable & sustainable product. Most decentralised and permissionless liquidity models are all fundamentally broken due to the above weaknesses and current markets are very inefficient, both for liquidity providers and traders.

Within on-chain options protocols, there is a significant lack of self-sufficiency/sustainability, with many relying on implied volatility or price feeds from Deribit, without their own price discovery mechanism. A significant lack of liquidity with most protocol TVL’s below $10mm also means that even for retail traders, any relatively small size will result in a decent amount of slippage for trade execution, which is perhaps the single largest determining factor for options protocol usage after accurate options pricing. Current on-chain option protocols pale in liquidity to Deribit but there is potential for the space to grow as developers create more efficient and sustainable liquidity models and allow traders to hedge risk, especially for long tail tokens.

The protocol that find a decentralised/permissionless liquidity model that is highly efficient for traders and liquidity providers (especially for long tail assets), allows for efficient price discovery within the protocol and an efficient arbitrage mechanism, and a liquidity model that can withstand high volatility periods will likely be the winner in the space and like centralised exchanges, build up liquidity as their moat.

Something that I am excited about is that the composability of DeFi means that option products can have additional utility, such as collateral for other positions or options for other assets such as NFTs (including membership, IP, arts, real world assets and more). On a similar note, developers can create novel option products such as power perpetuals or everlasting options (which to be fair, they can only do so due to a lack of a regulatory framework).

no need to write this much, just get your point across